Guide to Maine Short-Term Rental Regulations

Disclaimer

Short-term rental regulations are in a constant state of change. The below resource is updated when possible, but it should not be taken as legal advice. It is critical that you consult with a legal advisor to ensure you are taking the necessary steps to keep your business safe and legal.

Maine short-term rental laws are stricter than in many other states. Depending on which city you own and/or operate a vacation rental in, you may have to register your short-term rental with your local government.

Because Maine Airbnb laws vary by city, it’s important to be aware of specific regulations in your area. Let’s take a look at the various Maine short-term rental regulations that may affect you if you own and rent out a vacation home or run a

vacation rental management business in Maine.

Vacation (Causal) Rental Tax in Maine

The state of Maine requires that short-term rental operators, homeowners, or anyone who collects rent on behalf of the owner register for and collect a

9% Vacation (Casual) Rental Tax. The rental does not have to be advertised in order for this tax to apply.

There are some exemptions to this

Maine vacation rental tax:

- Casual rentals for fewer than 15 nights in a year: This applies to owners who only have one rental unit, like a room or condominium, and rent it out for less than 15 days per year. However, once you place your property in the hands of a real estate agent, or if you pay a property manager any amount of short-term rental management fees to run your property for you, they must collect and report 9% tax, regardless of how long the unit is rented out.

- Occupancy for 28 days or more: Rent charged to someone who rents continuously for 28 days or more is exempt from this tax if this renter uses the unit as their primary address or is renting it in connection with education or employment.

NOTE: If you list your property on Airbnb, the platform will

collect and remit sales tax from guests on behalf of the owner in the amount of 9% of the listed rent amount and any applicable cleaning or booking fees.

Cities in Maine with Short-Term Rental Regulations

If you rent out a vacation home in Maine, you need to be aware of potential regulations that could affect your activity. Here are some of the cities that enforce Maine short-term rental regulations.

Rockland

Rockland allows short-term rentals with the proper permits (

Rockland Ordinance – Chp 19 – Section 19-309).

- Only single-, two-, and, and multi-family properties are permitted. Short-term rentals are not permitted in any other structure (trailer, tent, recreational vehicle, etc.).

- A short-term rental application must be filed with the Rockland Code Enforcement office; one application per rental unit.

- The application requires an annual fee of $500.00 to be paid per short-term rental unit.

Bar Harbor

Short-term rentals are permitted in single-family, double-family, and certain apartment buildings with the proper registration. Owners and owner agents must submit information on every rental they own or manage, and allow for proper inspection to ensure the property complies with city regulations.

Here’s an overview:

- Short-term rentals must be registered on an annual basis with the town of Bar Harbor.

- In order to obtain a registration card, an application must be filed with and a fee paid to the town of Bar Harbor, and the property must be inspected by the Fire Chief and Code Enforcement Officer.

- The registration number must be posted in the short-term rental property for guests to see, along with an emergency information sheet.

Portland

Portland, Maine, Airbnb rules are especially stringent. In fact, in the 2022 midterm elections, there were two proposals (neither of which passed) that aimed to restrict who could operate vacation rentals in the city.

But an ordinance did go into effect in 2018 that requires all owners and owner agents to submit detailed information on every rental they own or manage, as well as adhere to the local ordinance and zoning laws.

Additionally, a rent control ordinance passed in 2021 also applies to short-term rentals in the city. This means owners can only annually increase their rates as much as the inflation rate.

Here is an overview of short-term rental regulations in Portland:

- Portland city inspectors must inspect each short-term rental for proper building code and fire safety compliance.

- Portland reserves the right to inspect the property at any time and request rental history, transaction data as well as upcoming bookings.

- Operators and owners have 48 hours to reply to a request before a penalty is issued.

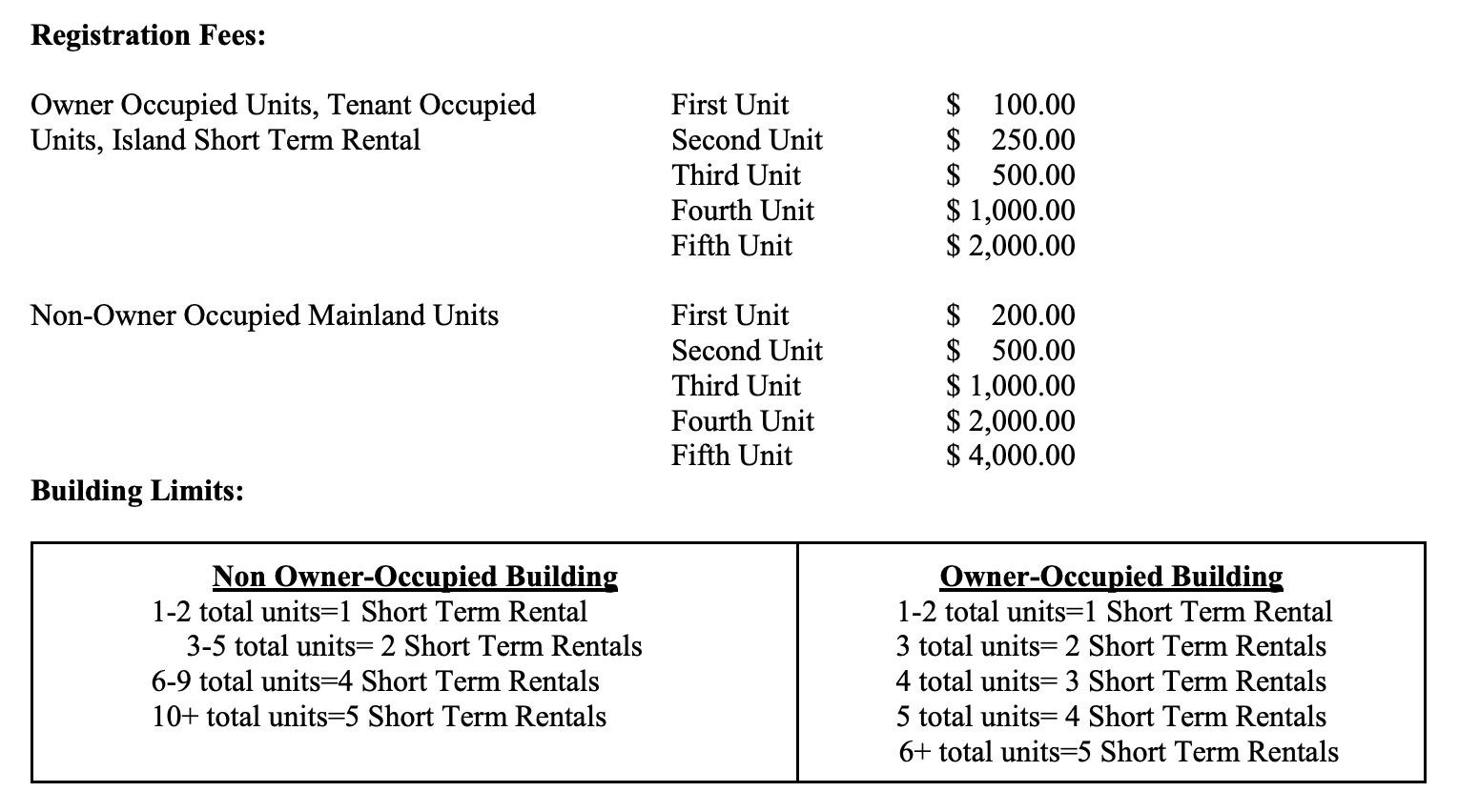

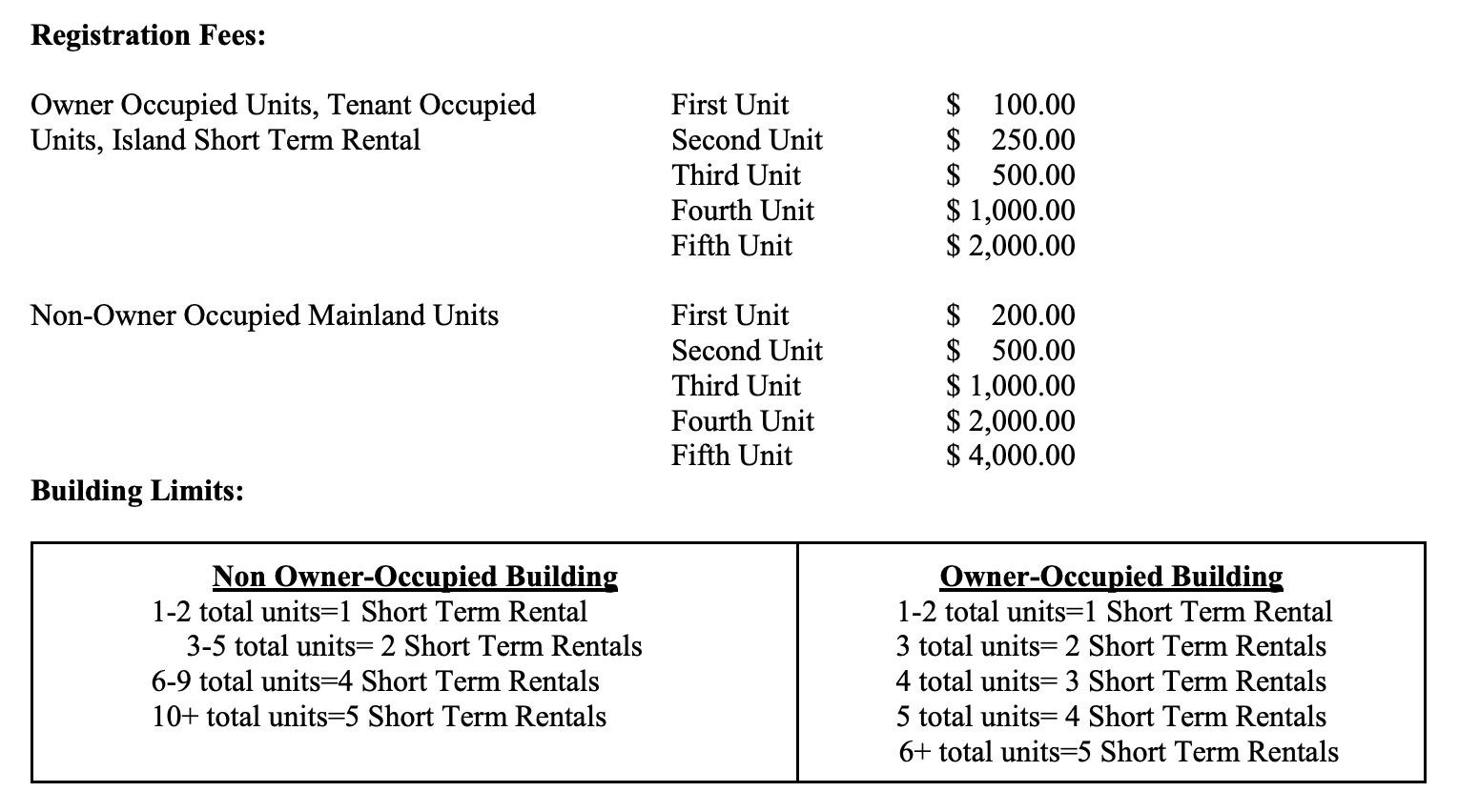

- Short-term rental regulations in Portland require vacation rental operators to register yearly and pay a fee for every unit they run

- Renewals must be submitted by January 1st each year.

- A maximum of 400 non-owner occupied (or “unhosted”) units can be registered in a year on the mainland.

- Property owners may register up to 5 short-term rentals.

- There is a cap of 5 living spaces that can be rented in any one single owner-occupied property (this includes bedrooms and separate spaces).

- Non-owner-occupied condominiums and single-family homes may not be rented short-term.

- When registering an owner-occupied short-term rental, only homes or apartments used as primary residences will be permitted.

- Max. two guests per bedroom, with only one additional space allowed per short-term rental that can be occupied by max. two additional guests.

- All short-term rental advertisements must include the city-issued regulation permit registration number. Multi-unit buildings have their own limitations.

- Owners and property managers can only raise their rates on an annual basis and this amount cannot exceed the inflation rate

As you can see from the registration fees, it becomes increasingly more expensive as you own and operate more short-term rentals in Portland, Maine.

Source:

City of Portland Short-Term Rental Registration Application

| Want to make running your short-term rentals in Maine as seamless as possible?

Hostfully’s property management software can make your job easier while boosting bookings.

Request a demo today! |

Frequently asked questions about short-term rental regulations in Maine

What is considered a short-term rental in Maine?

According to the

State Legislature, a short-term rental in Maine is “A residential property that is rented for vacation, leisure or recreation purposes for a week or a month, and typically under 30 days but not for more than an entire summer or winter season, to a person who has a place of permanent residence to which the person intends to return.”

Is Airbnb allowed in Maine?

Airbnb is allowed in Maine. However, there are a few regulations that short-term rental operators in Maine should be aware of. First, anyone who runs a vacation rental in Maine has to collect and pay

vacation rental taxes.

Additionally, some cities, like Rockland, Bar Harbor, and Portland, require you to register your short-term rental. In many cases, you must also pay a registration fee.

Is there a short-term rental tax in Maine?

There is a short-term rental tax in Maine. Also called the vacation (causal) rental tax, short-term rental operators in Maine must collect and pay a 9% tax on all their short-term rental reservations (certain exclusions apply).

Resources

As you can see from the registration fees, it becomes increasingly more expensive as you own and operate more short-term rentals in Portland, Maine.

Source: City of Portland Short-Term Rental Registration Application

As you can see from the registration fees, it becomes increasingly more expensive as you own and operate more short-term rentals in Portland, Maine.

Source: City of Portland Short-Term Rental Registration Application