Guide to short-term rental regulations

Select the location you want to learn more about the rental regulation

California

Guide to California Short-Term Rental Regulations

Disclaimer

Short-term rental regulations are in a constant state of change. The below resource is updated when possible, but it should not be taken as legal advice. It is critical that you consult with a legal advisor to ensure you are taking the necessary steps to keep your business safe and legal. California short-term rental regulations can be hard to find and understand. Below is a comprehensive look at the California short-term rental laws that might affect you if you own or operate a vacation rental in the state.California laws related to short-term rentals

Anyone who wants to operate a short-term rental in California needs to detail state and local regulations in their vacation rental business plan. So it’s important to do your research ahead of time. If you own or operate a vacation rental in the state, you should know that most California short-term rental laws exist at city level. At the state level, California places most of the responsibility for complying with regulations on the vacation rental hosting platforms (ie Airbnb, Vrbo, HomeAway, etc.). Vacation rental laws in California reinforce existing housing laws, which are:- Subletting: Section 22592 forces the vacation rental hosting platform to inform a potential host that his or her current lease must not contain restrictions that would limit renting the residential unit. Most of the time, that would include limitations on short-term rentals by an HOA or a sublet prohibition in a lease agreement.

- Insurance: Section 22592 also forces the hosting platform to inform the potential host that he or she must review insurance coverage. The host must make sure that coverage includes damages or injury protection resulting from operating as a vacation rental.

Cities in California with short-term rental regulations

As mentioned, Airbnb regulations in California are determined by each city. Take a look at the laws that will affect you if you want to run a short-term rental or operate a vacation rental management business in San Diego, Los Angeles, Santa Monica, or San Francisco.San Diego

San Diego short-term rental regulations are quite strict, and the city recently approved a new ordinance that will cut the number of short-term rentals permitted in half. As of July 2022, the city had some 13,000 short-term rentals. New regulations will limit that number to 6,500. And in Mission Beach, one of San Diego’s biggest tourist areas, vacation rentals will be capped at 30% of available units.- Short-term rentals in San Diego are separated into four different categories: part-time rentals rented 20 days a year; home-sharing rentals; whole-home rentals outside of Mission Beach; and whole-home rentals in Mission Beach.

- If your unit falls under tier three or four (whole-home rentals in or outside of Mission Beach), you must enter a lottery when applying for your license.

- There can only be one license and one short-term rental unit per host.

- The license cannot be transferred from one owner or location to another.

- Short-term rental operators in San Diego must have a Transient Occupancy Tax Certificate and collect and pay Transient Occupancy Tax (TOT).

- You can only use an approved unit as your short-term rental property. This excludes income-restricted affordable housing units, shipping containers, tree houses, student housing, RVs, and boats.

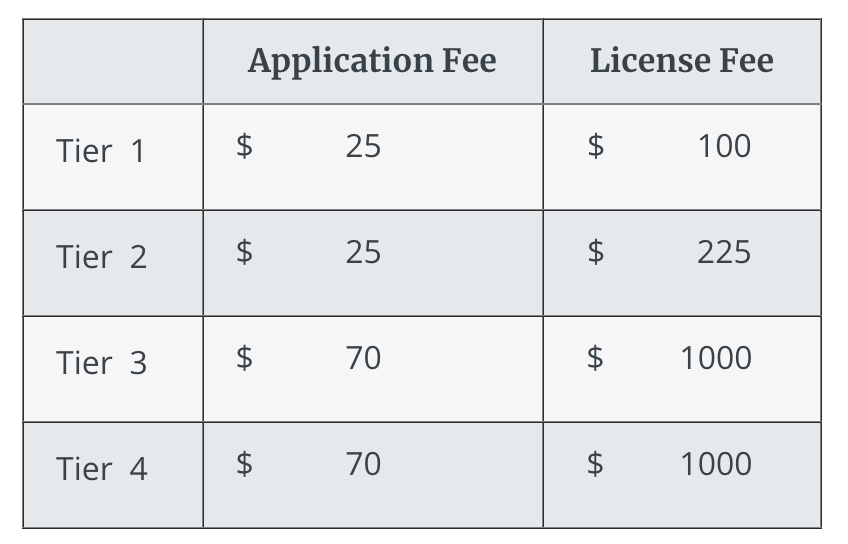

- You must pay an application and license fee upon registering your short-term rental.

Source: The City of San Diego Short-Term Rental Occupancy

Los Angeles

In 2019, the city of Los Angeles began enforcing the Home-Sharing Ordinance, which requires owners and hosts to register their short-term rental and advertise their registration number on all their listings. In summary, the legislation aims to restrict short-term rentals to an owner’s primary residence.- Hosts must register their home as a standard home share (which allows them to rent out all or a portion of their home for up to 120 days per year) or an extended home share (which allows them to rent out all or a portion of their home for more than 120 days per year).

- To register, a host must provide documentation of their primary residence.

- If the host is a renter (and not owner) of the property, they must provide a signed and notarized affidavit from the owner that approves their actions.

- There are other rules and guidelines that hosts must adhere to, such as listing only on approved platforms, only booking one set of guests at a time, providing a code of conduct to guests, and paying a home-sharing fee of $3.10 per night.

Santa Monica

Investing in vacation rental properties in Santa Monica isn’t easy since the city adopted a strict home-sharing ordinance back in 2015. This prohibits anyone from operating vacation rentals. This law was enacted to clarify the city’s long-standing prohibition on vacation rentals and to allow residents to rent out a spare room in their house. The city divides short-term rentals into two types of properties: home-sharing properties and vacation rentals. Home-sharing is defined as the rental of 30 consecutive days or less of one or more bedrooms in the host’s primary home while the host lives on-site during the guest’s stay. The ordinance requires hosts to apply for a home-sharing permit before participating in any rental activity, as well as collect a Transient Occupancy Tax from guests. The city defines vacation rentals as “The rental of 30 consecutive days or less of a home, in whole or in part, for exclusive transient use. The visitor enjoys the exclusive private use of the unit.” As we mentioned, Santa Monica prohibits anyone from operating a vacation rental in the city.San Francisco

Prior to 2015, operating a short-term rental (defined as offering stays of less than 30 days) in San Francisco was illegal. But, due to the rise of popularity in short-term rentals, the city passed new legislation that permitted the practice (while keeping it highly regulated). To host a short-term rental in San Francisco, you must meet a number of requirements. Also, register your business and fill out an application with the Office of Short-Term Rentals.- To run a short-term rental in San Francisco, you must be a resident of the city. You must also be the owner or tenant of the property you are renting out.

- You must have lived at the property you plan to rent for at least 60 days before renting it out, and plan to live in the unit for at least 275 nights per year.

- You can only rent 90 “unhosted nights” per year. These are nights when you aren’t present at the property during your guests’ stay.

- You must collect a 14% Transient Occupancy Tax from guests.

- You must renew your certificate with the Office of Short-Term Rentals every two years.

- A different permit is available for hosts of “intermediate occupancy” rentals (stays of more than 30 consecutive days but less than two years).

| Want to make running your short-term rentals in Maine as seamless as possible? Hostfully’s property management software can make your job easier while boosting bookings. Request a demo today! |

- The City of San Diego: Short-Term Rental Occupancy Ordinance

- The City of Los Angeles: Home Sharing Ordinance

- The City of Santa Monica: Overview of the Home-Sharing Ordinance

- The City of San Francisco: Guide to opening a short-term residential rental