If you’re considering starting a vacation rental business, no doubt you’re wondering whether you need a license.

The short answer is ‘probably’. Most places regulate the use of short-term rental properties nowadays, which means they usually require you to meet certain conditions and obtain a license.

But the situation is far from straightforward as the rules vary across locations and there are often different types of licenses. Some hosts might just need to complete a five-minute online form. Others may need to put aside weeks and months to secure different types of permits and approvals.

Our guide tells you everything you need to know about short-term rental licenses to help you get started. It covers how they work, the different types, and what next steps to take.

What is a Short-Term Rental License?

A short-term rental license is a legal document that gives you permission to rent out a property for brief periods, typically under 30 consecutive days. Confusingly, they can go by a variety of different names such as:

- Short-term rental permit

- Vacation rental license

- Transient occupancy license

- Tourist accommodation license

- Homestay permit

- Rental dwelling license

Licenses are usually issued by your city council. The council uses them to monitor short-term rental activity in the area, check everyone’s following the law, and maintain a list of contacts in case of complaints or issues.

In most cases, you can’t simply file for a short-term rental license. The local authorities typically require you to undergo certain checks and inspections before they even consider your application. Then afterward, they expect you to follow certain rules or they’ll revoke your license and potentially reject future applications.

Licensing can have a significant impact on STR management. As Allegra Muzzillo, owner of ACM Interiors, says, “It means more taxation and fees and hoops to jump through. Vacation rental operators need to know what they’re getting into – research the local area before investing in a property because it might not turn into the moneymaker you expect.”

What does a short-term rental license contain?

Authorities tend to send you the short-term rental license as a downloadable PDF so you can print and display it. The license usually contains:

- The governing body

- Their contact information

- The permit number

- The owner or property manager’s information

- Some property details

- The type of short-term rental license

- The issuance and expiry date

- Terms and conditions

Here’s an example of one from the City of Richmond in the United States:

What are the different types of short-term rental licenses?

Not all short-term rental licenses are the same. Local authorities often have a selection to cater to different locations, property types, and business setups.

Here’s a quick breakdown of the common types so you can see what to expect:

Primary residence versus secondary residence

License types are often based on whether owners reside at the property. Generally speaking, if you spend most of the year at the property, it’s classed as your primary residence. And if you only spend up to a few weeks there, it’s your secondary residence.

Most authorities have strict criteria. For example, they might class a primary residence as somewhere you live for no less than 180 days out of the calendar year. Or they might require you to have registered for taxes, mail, and ID using the property’s address.

As secondary residences get more traffic, local authorities tend to regulate them closely. They might cap the number of licenses issued per neighborhood or limit the number of nights you can accept bookings. Often, they may require you to undergo extra checks to ensure the property meets standards and your business won’t negatively impact the community.

Owner-occupied versus non-owner-occupied

Owner-occupied rentals involve someone remaining on-site during the guest’s stay rather than managing the vacation rental remotely. They’re generally easier to license as local authorities see them as having a lower impact on the community. As short-term rental hosts are always on-site to monitor guests, the idea is that there should be less antisocial behavior like littering and loud parties.

On the other hand, non-owner-occupied rentals are more tightly regulated. Many cities charge extra for this type of license and apply extra rules and restrictions.

They may also expect you to present guests with a short-term rental agreement outlining certain rules and ensure they follow them. Fortunately, you can now automate this entire process through your property management system (PMS).

Individual versus business

Licenses sometimes differ based on whether the applicant is a person or a business entity. The requirements may be the same but the business version might allow the entity to manage licensing for multiple properties at once.

Often there is very little difference. The local authorities just wish to know whether the property is being managed by an individual or a company for their records.

Room versus whole home

Some cities distinguish between renting out a room or a portion of the property and giving guests access to the entire place. The way they handle each type of license depends largely on issues facing the local community.

If housing is a widespread problem, your local authorities may be more likely to encourage single-room rentals or accessory dwelling units. This setup means the owner can remain on site instead of living elsewhere and reducing the number of available properties.

But if your government wants to boost tourism, they may favor whole room rentals. These properties enable them to increase their lodging capacity without investing in new hotels, hostels, and other tourist establishments.

Annual versus seasonal

Finally, licenses may be issued on an annual or seasonal basis. As the names suggest, annual licenses let you accept guests all year round and seasonal ones limit business activity to specific months. For example, a mountain town might let residents open their properties to tourists during the winter months when everyone visits to enjoy the ski slopes.

How to get a short-term rental license: A quick step-by-step guide

Short-term rental applications are often the biggest hurdle to starting a new business. You usually can’t accept a single booking until the government approves your application and sends you the document.

The good news is that the application process is quite predictable. While there may be some variations between locations, here are the steps you normally have to take:

- Complete an online form: Most cities have an online gov portal where you can apply directly for a license. This usually involves creating an account and answering a few questions about you and your property.

- Provide supporting documents: At the least, you’ll be expected to supply government-issued ID and evidence that you either own or have permission to use the property.

- Undergo inspections: As part of the process, the government may schedule a health and safety inspection to check your property meets acceptable standards.

- Pay the application fee: Normally, you must pay the license fee plus any processing charges upfront. You can usually do this via the government website or even as part of the online application form.

- Await approval: You can’t accept bookings until the local authorities approve your application. As soon as you receive the license, you must often display a physical copy somewhere visible on the property and add the unique license number to all your online listings.

As local governments become more concerned about housing availability and crime, some have begun to add more steps to verify businesses. Muzzillo notes that “Paying is the easy part. Maintaining compliance is usually the reason owners need to jump through hoops. And in many states, they’re making it harder and harder to use your property the way you would like.”

That’s why you can take nothing for granted. Always research the application process and look at potential upcoming changes before deciding upon a certain location.

Want a closer look at the application process in your location? Check out our series on short-term rental regulations across various states and cities.

What paperwork is required in addition to a STR license?

Obtaining a short-term rental license is often just one step. Many local authorities require additional paperwork to help them manage zoning compliance, tax collection, and health and safety standards.

While not all this paperwork applies in every location, it’s worth knowing what might come up during the application process.

Business license

Most cities require you to get a general business license for any income-generating activities. This applies whether you’re managing multiple rental units or renting out a single room under your own name. The license helps the government track who’s running a business, making it easier to regulate their activities and tax them correctly.

Tax registration

You might need to sign up to pay for transient occupancy taxes (TOT) or your region’s equivalent. If you’re in the US, you may need to create accounts at both the state and the city or county level.

Some cities combine tax registration with the business permit to make the process simpler. For example, Seattle only requires you to apply for its Business License Tax Certificate. But this largely depends on how the local government is structured as one department may regulate businesses while another handles tax collection.

After you’ve registered, you must stay up to date with tax payments to avoid complications. Use software like Hostfully to apply the right fees and keep a precise record of all your remittances.

Zoning and land use clearance

If your city has strict zoning laws, you might need to obtain a permit to prove you have the right to use the property or the land to run your business. This paperwork goes by different names depending on precisely what you want to do, including a zoning clearance, land use permit, and conditional use permit.

Some cities are more clear-cut. Residents either have the right to operate businesses out of their property in certain zoning districts or they don’t and it’s simply a matter of checking.

H3: Health and safety certification

You may need to undergo inspections and certification to confirm your rental property meets certain standards. Depending on your location, this may involve:

- Fire safety: A check to confirm your property has working smoke and carbon monoxide detectors, fire extinguishers, and clear escape routes.

- Building code compliance: An inspection of the property’s general habitability including the structural integrity, guardrails, and ceiling heights.

- Electrical and heating system: Routine checks to assess the safety and functionality of your gas line, electrical outlets, and radiators.

- Occupancy: A verification that your property includes the number of bedrooms, bathrooms, and kitchen facilities laid out in your license application.

Some of these require you to get certified annually while others may be after key events like renovations or extensions. They should be outlined in your license application on the website portal and in your city or county’s bylaws.

Sometimes the paperwork required can make it challenging to launch your business. If you can be flexible about location, Muzzillo suggests choosing based on the leniency of the short-term rental laws and the complexity of the processes.

“When we relocated from New York to Florida, we specifically sought properties popular with tourists that allow nightly rentals so we didn’t have to worry so much about changing laws, taxes, and fees and scurrying around to become compliant.” she says, “A ‘grandfathered-in’ opportunity like this didn’t exist where we owned in the past, and we’re very happy with it so far.”

What are the penalties for STR license violations?

Local governments take short-term rental compliance seriously as it affects everything from housing and taxes to crime rates. They often have penalties in place for operating without a license or breaking license conditions.

Here’s a quick breakdown of the most common types of enforcement action:

- Fines

- Legal action

- License revocation

- Temporary bans

- Permanent bans

Penalties vary according to the location and size of the infraction. For instance, cities with limited housing availability are more likely to have a large fine for operating in a residential area where vacation rentals are banned.

It’s best to fix issues as quickly as possible as governments usually escalate. As an example, East Haven, Connecticut, just introduced an ordinance that allows the city council to fine businesses $500 per day for unresolved penalties.

Get ahead of the paperwork with Hostfully PMS

STR licenses can vary widely depending on your property, location, and business structure. Learning which type you need to apply for is an important step.

Afterward, staying compliant with the license terms and conditions helps you avoid fines. It also helps you foster trust with residents in your area and encourages the local government to continue taking a permissive approach to vacation rentals.

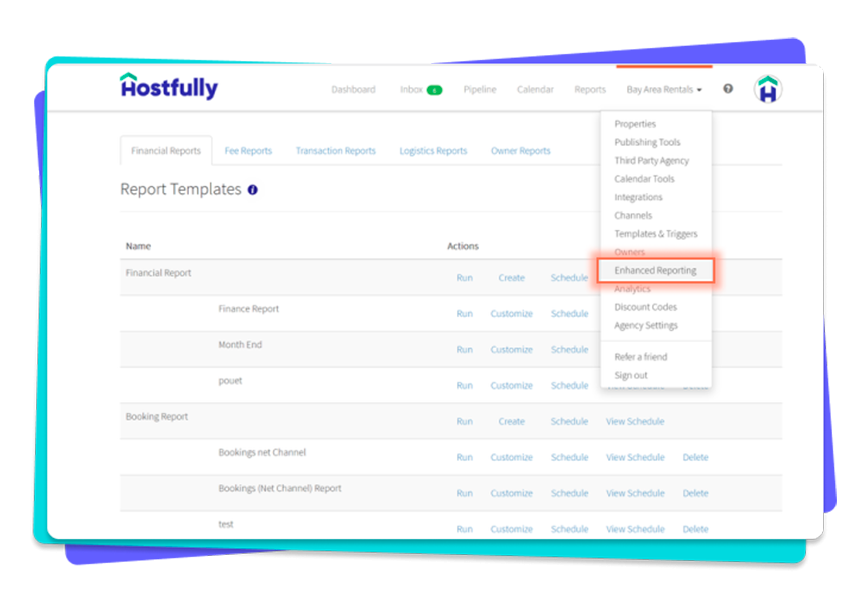

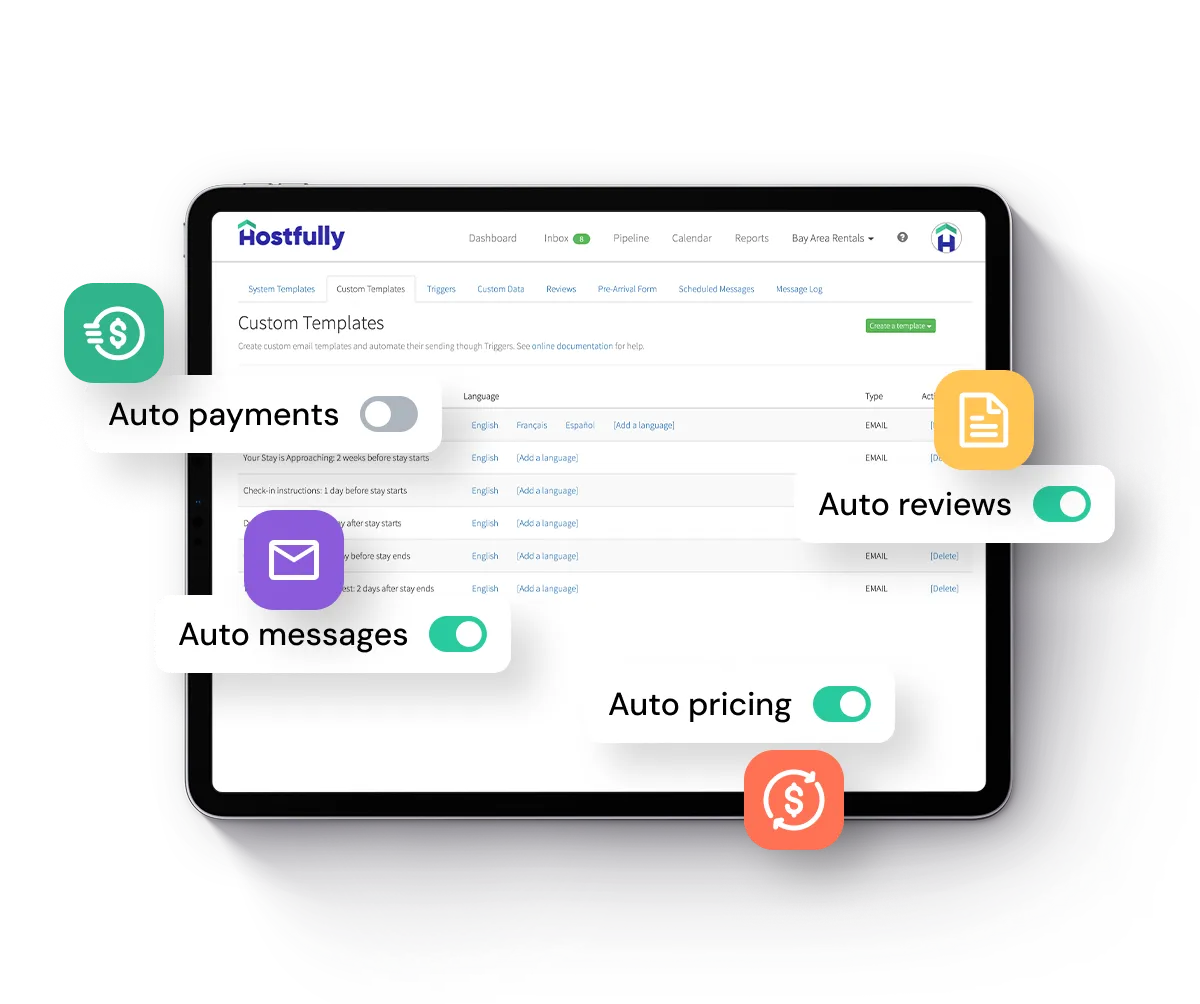

Hostfully PMS makes it easier to stay on top of compliance. Our software is full of little features like:

- Automation tools to ensure you send the property rules and short-term rental agreement to every guest ahead of arrival

- A channel manager that synchronizes information across listings, ensuring your license number is in all the right places

- Task management so you can arrange cleaning promptly and keep meeting standards

- A centralized AI inbox to help you catch property issues before they turn into major license violations

Remember, STR licensing isn’t just a hoop to jump through — it’s part of running a reliable, sustainable business.

FAQs about STR License

How long does it take to get a short-term rental license?

The length of time it takes to get a short-term rental license varies across locations. Some cities process your application within a few business days while others might need a few weeks to check all your paperwork.

Can I operate without an STR license?

No, you probably can’t operate without an STR license in your area. Most jurisdictions have made it a requirement over the past few years as they regulate Airbnbs and VRBO properties more closely.

How much does a short-term rental license cost?

The cost of a short-term rental license can vary widely. Most states and cities only charge between $50 and $150 per year for an annual license but some popular tourist destinations have raised the fee to over $500.

What happens if I don’t renew my STR license?

If you don’t renew your STR license on time, you’ll probably just receive a fine. But if you operate your business for months without licensing, you’ll face harsher consequences such as legal actions and sanctions.