Nobody ever became a vacation rental manager because they love financial paperwork.

But if you want to maintain control over your business, list on more platforms, and take direct bookings, there are advantages to being your own merchant of record (MoR).

As your own MoR, you’ll be able to make more strategic choices that have a major influence on the direction and growth of your business.

But understanding what that means, and how to do it, can be confusing. Especially if you’re no financial expert, and just want to make your guests happy. There are also some downsides that you need to be aware of first.

That’s why we’ve explained:

- What a merchant of record is

- Merchant of record vs seller of record

- Merchant of record vs payment solution

- How online travel agents (OTAs) and channel managers act as merchants of record

- The pros and cons of being a merchant of record

- How to become your own merchant of record

What is a merchant of record?

Source: Karolina Grabowska / Pexels

A merchant of record (MoR) is the entity that:

- Sells services or goods to a buyer

- Appears on guests’ bank statements when they pay

- Is responsible for all transactions, cash flow, payment processor fees, financial management, and records of a sale

- Is responsible for processing refunds, chargebacks, legal compliance records, and taxes

It’s also important to know the difference between an MoR and a Seller of Record (SoR).

What’s the difference between a merchant of record and a seller of record?

The terms merchant of record (MoR) and seller of record (SoR) are very similar and are often used interchangeably. In fact, in this post, we’ve generally used the term MoR as a catch-all for both.

In practice, for vacation rental hosts or management companies, the main need-to-know is this: If you handle payments via your own payment processor account, then you are the MoR. And if you are using Airbnb for your business only, then you are not the MoR.

That said, there is a difference and it’s good to understand the distinction, which you can see below:

- Merchant of Record: The legal entity identified that handles all payments, takes the money from the buyer, gives the money to the seller, and processes all transactions according to the laws of the country in which the buyer is located. It also keeps records of all transactions.

- Seller of Record: The entity, company, or person who is ultimately authorized to take payment for selling a service, who is providing that service, and receives the money at the end. The seller is required to pay all taxes on their income and adhere to any other financial compliance rules.

What’s the difference between a merchant of record and a payment solution?

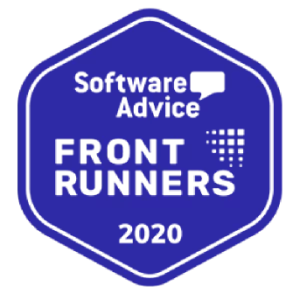

Source: Stripe.com

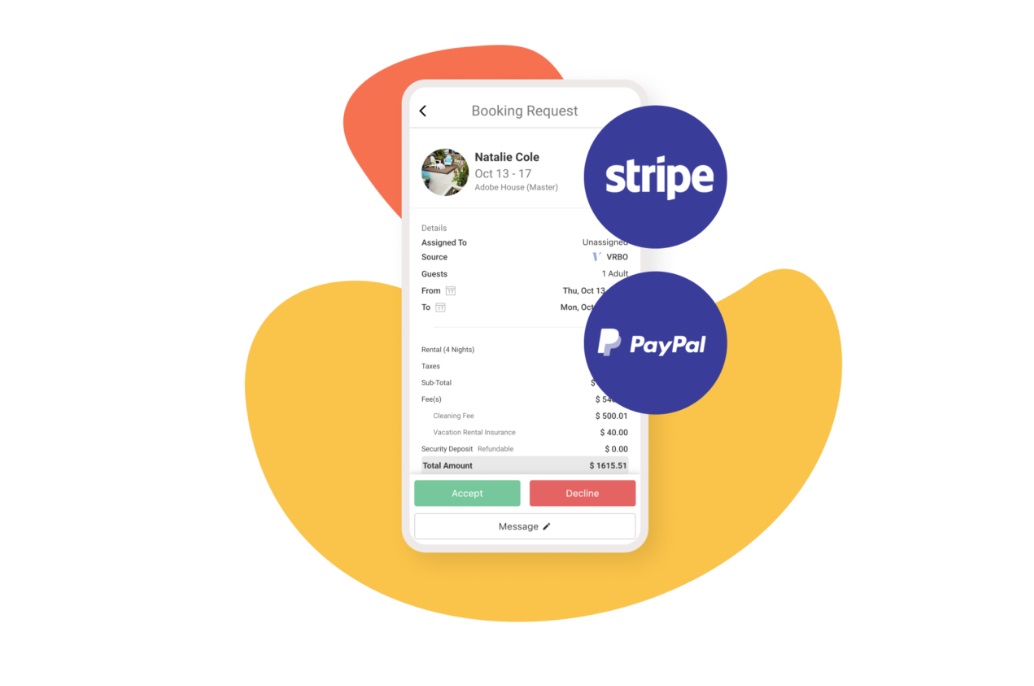

An MoR or SoR are also not the same as a payment processor or payment service provider. Payment processors like Stripe provide the technology to take payments from a customer’s card and transfer the funds.

But an MoR’s responsible for setting up the process of when payments are taken and paid, and they’re also legally responsible for taxes, fees, chargebacks, refunds, and legal compliance.

How OTAs and channel managers act as MoRs

Source: Airbnb.com

Not all OTAs or vacation rental channel managers operate in the same way when it comes to being an MoR.

See the following two examples:

Airbnb is an MoR

Airbnb is the MoR for any stays sold through its platform.

This is because it handles all money and transactions through its own website. It also has a payment processor, so you don’t need a separate payment processor, like Stripe, to get paid on Airbnb.

Airbnb maintains control of when it takes money from the buyer and when it transfers the money to the host. It also keeps track of all transactions and fees. However, you, as the rental host who receives the money in the end, are still usually liable for taxes on your income and for complying with local regulations for Airbnb.

Vrbo and Booking.com are not MoRs

Source: Booking.com

In contrast, platforms like Vrbo or Booking.com do not have their own payment processors. Nor do they handle any payments directly through their platform. They are not the MoR.

You must connect a separate payment processor that you are responsible for, such as Stripe, to use their platforms, and handle all payments and transactions yourself. This makes you the MoR when you use these websites.

Lastly, if you take direct vacation rental bookings, you are the MoR, even if you use a payment processor like Stripe or PayPal to actually take payments.

Pros and cons of being the merchant of record for your vacation rentals

| ✅ Pros ✅ | ❌ Cons ❌ |

|

|

Pro: You maintain cash flow control

Source: Tima Miroshnichenko / Pexels

When you handle payments, you can see what’s coming in and when. And you have control over the cash flow, with the ability to make lump-sum deposits on your terms.

This means, when it comes to paying out to your homeowners or paying wages to your cleaners, you’re not waiting on a trickle of OTA payments whose timing and quantities are out of your hands. Instead, you can plan all your financial movements according to your own convenience.

As the MoR, you can also show more extensive financial records to interested parties, such as tax officials or property owners.

Pro: You can build a closer guest-manager relationship

Source: Ivan Samkov / Pexels

Being your own MoR means you can keep a closer relationship with your guest, especially if something goes wrong. For example, if the transaction is declined, as the MoR you’ll be alerted quickly. You’ll also be able to pinpoint exactly what’s gone wrong, so you can act fast to fix it rather than waiting for your external MoR to do so.

You’ll also have the guest’s details, so you can reach out to them directly and explain the issue. There’s no third party getting in the way, obscuring parts of the transaction, delaying the process, or making resolution more difficult.

For example, it’s frustrating as a property manager if a guest complains to the platform (say, via Airbnb guest support) and your hands are tied while you wait days or weeks for a customer care team to resolve the issue, without having sight of what’s going on or how long it could take. As the MoR, you could assess the level of urgency yourself, and potentially take steps to resolve the issue immediately.

You can also answer guest questions about fees or payments if they need more information. This helps to foster positive guest-host relationships, leading to better reviews overall.

Pro: You manage your brand and reputation

Source: Hostfully.com

As the MoR, you can maintain better control over your own reputation. If something goes wrong with a third party’s payment processing or other transactional tools, that will reflect badly on your business, even if it’s completely out of your hands.

In contrast, as the MoR, you will have more control over the payment processes, and you can work to ensure that your systems are a good reflection of your hospitality and professionalism.

Your name will also appear on the guest’s bank statement, further establishing you as a reputable figure.

Pro: You have more freedom when it comes to OTAs or direct bookings

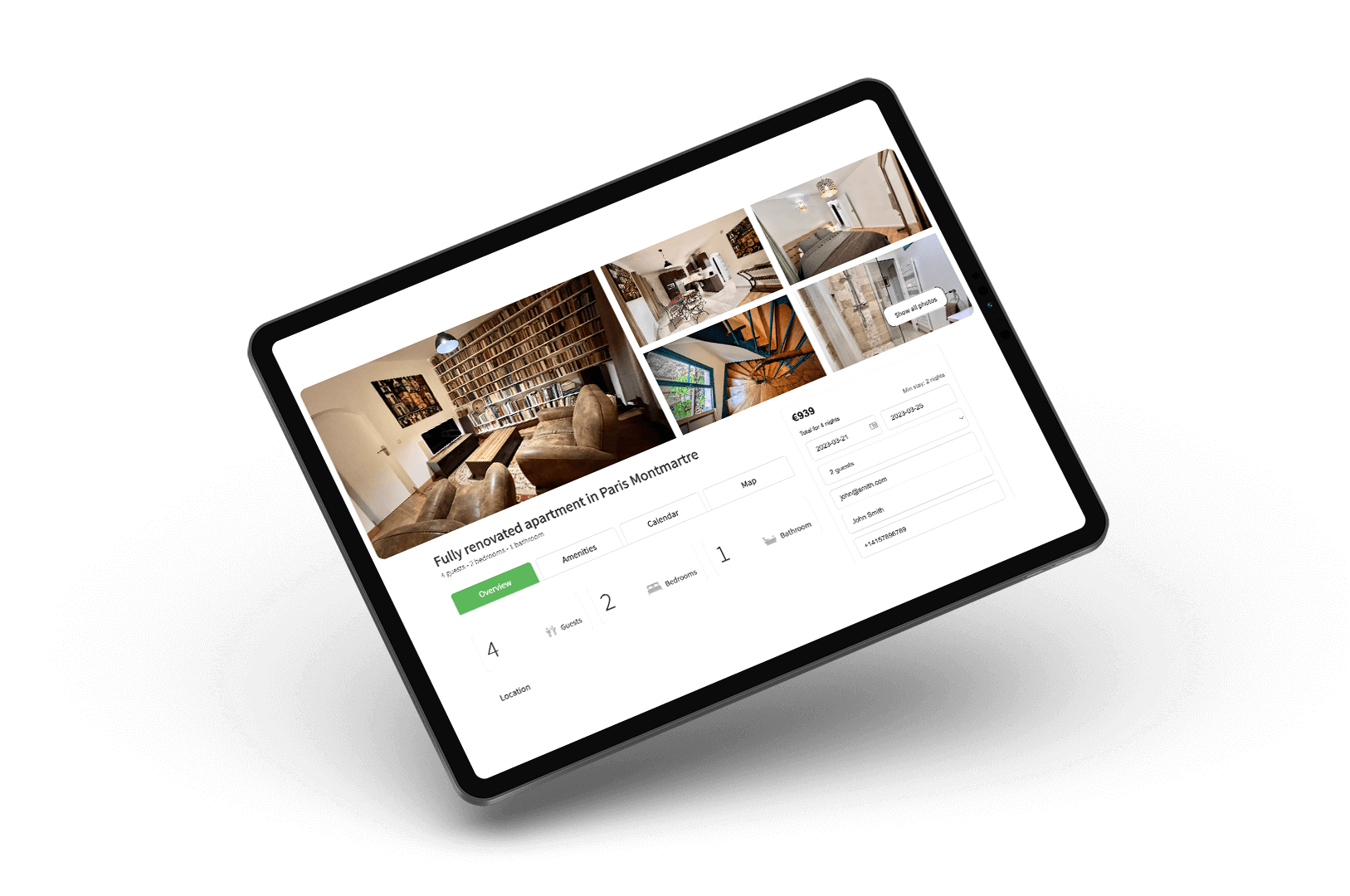

Source: Hostfully.com

Setting up your own MoR system gives you far more freedom when it comes to listing properties on distribution channels or selling stays directly.

You aren’t chained to a particular platform (like Airbnb), and you have the tools in place to list your properties on as many channels as you choose—even if those platforms also operate as an MoR. Using a channel manager via a property management system (PMS) like Hostfully makes this even easier.

More channels mean more eyeballs on your listings, more bookings, and more revenue (although, of course, more fees when you list on OTAs).

Happily, setting up as your own MoR also means you can transition to taking direct bookings more easily. Taking direct bookings boosts the authority of your brand, helps build a loyal customer base, and saves you big bucks on OTA fees.

Con: The financial responsibility stops with you

Source: Anthony Trivet / Pexels

Being your own MoR gives you control and freedom, but it comes with responsibilities—and a lot more paperwork.

If you’re the MoR, you’re responsible if there are issues with any payments, like refunds, chargebacks, and unpaid invoices. So, it’s up to you to chase up with the guest if their payment doesn’t go through.

You’re also responsible for managing tax records, and complying with local regulations and financial laws. And you must maintain your own payment processor and keep track of logins and settings.

Some payment processor tools offer help, though, and you may find an accountant or financial advisor who can assist, but the responsibility will always be yours.

So, if you’re content to only list on Airbnb, you don’t have to take on that degree of responsibility—you might miss out on business control and the ability to strategize and grow, but you’ll have fewer daily tasks and less legal liability.

How to become a merchant of record

Once you are responsible for the way you take the money and redistribute it (e.g. pay yourself and your cleaner), you’re the MoR.

So, if you decide to go down this route, you first need to consider which payment processors will integrate with your systems, such as your PMS. This allows you to manage your new financial tasks with minimal complexity or stress.

And, once you start managing your Stripe or PayPal account for your vacation rental transactions from start to finish (so not just using PayPal to receive payments from Airbnb), you’re the MoR.

For example, if you have Stripe, you can set it up to handle payments for bookings you receive through Vrbo or Booking.com by integrating it with Hostfully.

Source: Hostfully.com

Hostfully offers direct integrations with:

- Stripe – Payment processor that accepts card payments for businesses based in 33 countries worldwide.

- PayPal – Online payment platform that uses email addresses to send and receive payments across more than 130 countries.

- VacationRentPayment – Online payment solution from global payments company YapStone, tailored to vacation rentals.

Once your payment processor is connected to a PMS like Hostfully, you can also use it to:

- Take extra payments like deposits or upsells made mid-stay

- Integrate it directly into your Hostfully-made website for vacation rental direct bookings

- Embed it into your third-party-made direct booking website via the Hostfully widget

This enables you to be the MoR for your vacation rental business, and maintain that all-important control.

Merchant of record: Take control of your business

Being the MoR for your vacation rental business has its pros and cons. Handling financial responsibility, and setting up payment logins and processes, can be complex. Especially if you’re a smaller host who is happy to outsource all that control and logistics to Airbnb—and give up control of that side of your business in the process.

But if you want to maintain control over your money, build closer guest-manager relationships, establish your own brand, and get business outside of Airbnb—including direct bookings— being your own MoR can benefit your business and help you grow.

Yes, it’s more complex—at least initially—but using a PMS like Hostfully allows you to streamline and automate.

Hostfully’s integrations with payment processors let you manage payments easily, while the channel manager lets you list on OTAs where you have to be your own MoR, like Booking.com and Vrbo.

And, with features that enable digital rental agreements, financial reports, and direct bookings, Hostfully makes sure you don’t have to be a financial expert to enjoy the benefits of being your own MoR.

Frequently asked questions about a merchant of record

Is PayPal a merchant of record?

No, PayPal is not a merchant of record. It is an online, digital payment processor. This means it provides the mechanism by which users make or receive payments. It uses users’ online accounts through which the user can request or receive money. However, PayPal is only the intermediary between the customer and the merchant of record.

Does Stripe act as a merchant of record?

No, Stripe does not act as a merchant of record. It is a payment processor that can handle credit card transactions. This means it provides the mechanism by which users receive payments, and can take money from one bank account and deposit it into another. However, it is only the intermediary between the customer and the merchant of record.

Is Google a merchant of record?

No, Google is not a merchant of record. Even if you use Google Pay to pay for services or products, Google is not the seller or buyer, so it does not assume responsibility for delivering that service or receiving the funds for its fulfillment. If you buy a product (or sell rental stays) through Google ads or via a search page result link, Google is only the third party that displays that product or stay. The transaction would still take place between the buyer and seller, so Google would not be the MoR in this case either.

Is Airbnb a merchant of record?

Yes, Airbnb is the merchant of record for hosts or property management companies that sell rental stays through its platform. This is because it handles all the transactions and payments on its own platform, without recourse to a third-party payment processor. It controls when it takes payments from buyers (guests) and when it transfers the funds to the seller (the property host or manager). It keeps records of all transactions. However, the host or manager is still responsible for declaring taxes on the income they receive, and the legalities of renting their property on Airbnb based on the regulations of the property’s location.