For vacation rental managers, business accounting isn’t always straightforward. You have to know how to understand accounting basics, dig for information, make financial projections, properly track income and expenses, and calculate taxes.

Luckily, you don’t have to be an accounting expert to handle bookkeeping and accounting for your Airbnb business. There are many intuitive, user-friendly Airbnb accounting software tools that can help you monitor cash flow, automatically create financial reports, and streamline all your online payments inside a single system.

Hostfully is an award-winning company with an expert team that gathers insights from Airbnb Superhosts, vacation rental and hospitality industry experts, and tech and travel professionals. In this article, we’ve analyzed five different accounting tools to help you make an informed decision about the best one for your business.

We’ll look at:

- Why you need Airbnb accounting software

- Five different accounting software (Quickbooks, Ximplifi, Sage Accounting, Wave, Xero)

- How to choose the right software for your business

Why do you need Airbnb accounting software?

It may seem like Airbnb accounting software is just a nice-to-have. However, it can be a lifesaver for both small and large vacation rental management companies. If you combine it with Airbnb property management system (PMS), you’ll be able to streamline internal and guest communications, sync your bookings and calendars, and enjoy a unified view of all your business operations.

Here’s why you should consider making Airbnb accounting software a part of your tech stack.

Make tax savings

A dedicated accounting software can help you keep a record of your Airbnb expenses and losses, which is necessary for filing for deductions when the tax season comes. Every short-term rental operator should be aware of the tax savings they can get.

Here’s a list of tax breaks you may be eligible for:

- Rental insurance

- Utility bills

- Property taxes

- Operational expenses (e.g. cleaning, maintenance, repairs, marketing, and advertising costs)

| Pro tip: Have you registered an official short-term rental business? If yes, you may be able to apply for a Qualified Business Income (QBI) deduction. This could save up to 20% of your rental income. |

Better track expenses

With Airbnb accounting software, it’s a lot easier to track expenses and financial commitments for services, clients, and buyers. Not only can the tool you choose facilitate your online payments, but it can also help you manage invoices, and have more control of the inventory thanks to real-time updates. Automatically generated financial reports also help you stay on top of everything while significantly reducing manual work.

| Pro tip: Make sure to open a dedicated bank account for your vacation rental property. This way, you can keep your personal account separate from your business one, which will make your business much easier to manage. |

Automate income and expense filing

It’s time-consuming to manually record and keep on top of income and expenses. Using Airbnb accounting software saves you precious time and helps reduce mistakes caused by human error, which are always possible. Automation is key to scaling your business and giving you back more time to focus on running your business. Make sure to check other solutions for automating Airbnb.

| Pro tip: Automate wherever you can—even outside of your accounting software. Well-built property management platforms (PMPs) like Hostfully that enable third-party integrations can do wonders for your productivity as they save you time switching between different tools and tabs.. |

Owner reporting

If you’re dealing with multiple owners, your accounting software can automatically generate reports for each unit owner. This saves a ton of time compared to preparing reports manually every time. Depending on the software you choose, some also provide profitability reports which will give you more insights into the health of your business.

Make smarter decisions

Keeping good records of your business financials requires managing payments, receipts, invoices, etc. All of this data is invaluable to inform your business decisions. Whether you operate alone or collaborate with several other property owners, you should review the numbers continuously and act proactively. It’s more reliable than trusting your gut feeling.

5 best accounting software solutions for Airbnb rentals

Let’s take a closer look at the best accounting software solutions and why Airbnb hosts love them.

QuickBooks

QuickBooks is an accounting software that helps you track, organize, and manage finances. It allows you to manage your vacation rental finances easier. Below you can see an overview of the main QuickBooks benefits.

| Benefit | Value |

| User-friendly | QuickBooks is designed to be very easy for beginners to use. |

| Custom invoices | It takes just a click to automatically generate an invoice or a receipt. It’s easy to create quotes that include discounts, payment terms, and more. The manual work is reduced to a minimum. |

| Tracking expenses | Photo records of receipts are safely stored within QuickBooks. You can also track VAT easily so you’ll be ready when tax time comes. |

| Useful reports | There are three main reports available in QuickBooks. You can generate accurate profit and loss statements, create balance sheets, or analyze the real-time report by looking at your company snapshot. |

| Cloud-based software | QuickBooks works from any device, mobile or desktop. The data gets updated in real time and you can provide access privileges to other owners or your accountant. |

Additional info: Insights, reports, inventory tracking, multiple currencies, and budget management are available from Essentials plan and up. As for integrations, QuickBooks supports many different types of integrations, including integrations with vacation rental PMP solutions such as Hostfully.

Pricing: QuickBooks offers a free 30-day trial and three different pricing plans starting from €16 per month. There are often great discounts for first-time users, so make sure to check their website for offers.

Reputation: Currently, QuickBooks has a score of 4* on G2. The software ranks the highest for ease of use, quality of support, and ease of setup.

Ximplifi

Ximplifi offers all-in-one accounting solutions designed especially with vacation rental businesses in mind. Compared to other accounting software, Ximplifi is actually a combination of tech and dedicated accountants that fully support your team. This means you can outsource your Airbnb accounting completely to Ximplifi if you want to.

Their main tech product is called VRPlatform™, an integration tool that connects your chosen PMS, accounting software, and billing software. It integrates with Hostfully as well.

| Benefit | Value |

| Automate everything | VRPlatform™ enables you to automate data transfer between your chosen PMS, accounting software, and billing software. It also helps you automate posting guest invoices, management fees, owner commissions, deposits, and more. |

| Owner statements management | Within the Owner Portal, you can easily prepare and pay out monthly statements in just a few clicks. |

| Cloud-based tech | All data is secure and updated in real time, so managers and owners can be sure they have the right financial reports at their fingertips. |

| Bank reconciliations | VRPlatform™ posts Airbnb payments daily. It even batches deposits to your bank ledger to make reconciliations easy. |

| Custom pricing | Ximplifi provides pricing upon request, you can book a demo on their website. See how they work here. |

Additional info: Here’s a useful webinar where Jesse Ehret, Ximplifi’s CEO, explains how vacation rentals can automate manual accounting tasks, how an effective accounting system can help, and why trust is important in accounting.

Pricing: Ximplifi provides pricing upon request, you can book a demo on their website.

Reputation: Has a great reputation and a lot of interesting case studies that serve as social proof.

Zapier integrations

There aren’t many dedicated Airbnb accounting software offerings that have direct integrations with property management systems. To get around this problem, you can create a bridge between the PMS and your chosen accounting software using integrations with Zapier.

Zapier is a no-code solution that lets you connect your PMS with Airbnb and thousands of popular apps. It lets you automate manual or repetitive tasks and gives you back more time to focus on running your business. Let’s take a look at three great accounting tools that you can connect with Hostfully or other PMPs for a more centralized property management experience.

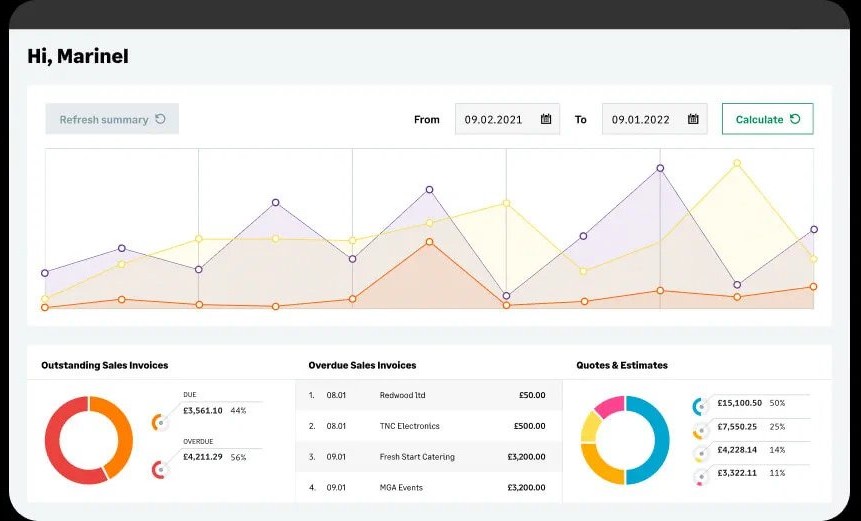

Sage Accounting

Sage Accounting software is designed for small businesses. Here’s an overview of its benefits:

- It allows you to record expenses from any property and review them using a mobile app.

- It provides real-time financial dashboards, reports, and cash flow forecasts

- It helps you reconcile bank transactions quickly or connect your bank accounts to import transactions automatically

- You can create personalized invoices or set up recurring ones

- You can manage your expenses and income, as well as taxes and VAT

Pricing: Pricing goes from £12- £33 a month (excludes VAT). First month is free.

Reputation: Most users on G2 praise Sage Accounting software for ease of use, quality of support, and ease of setup. It has a score of 4.2

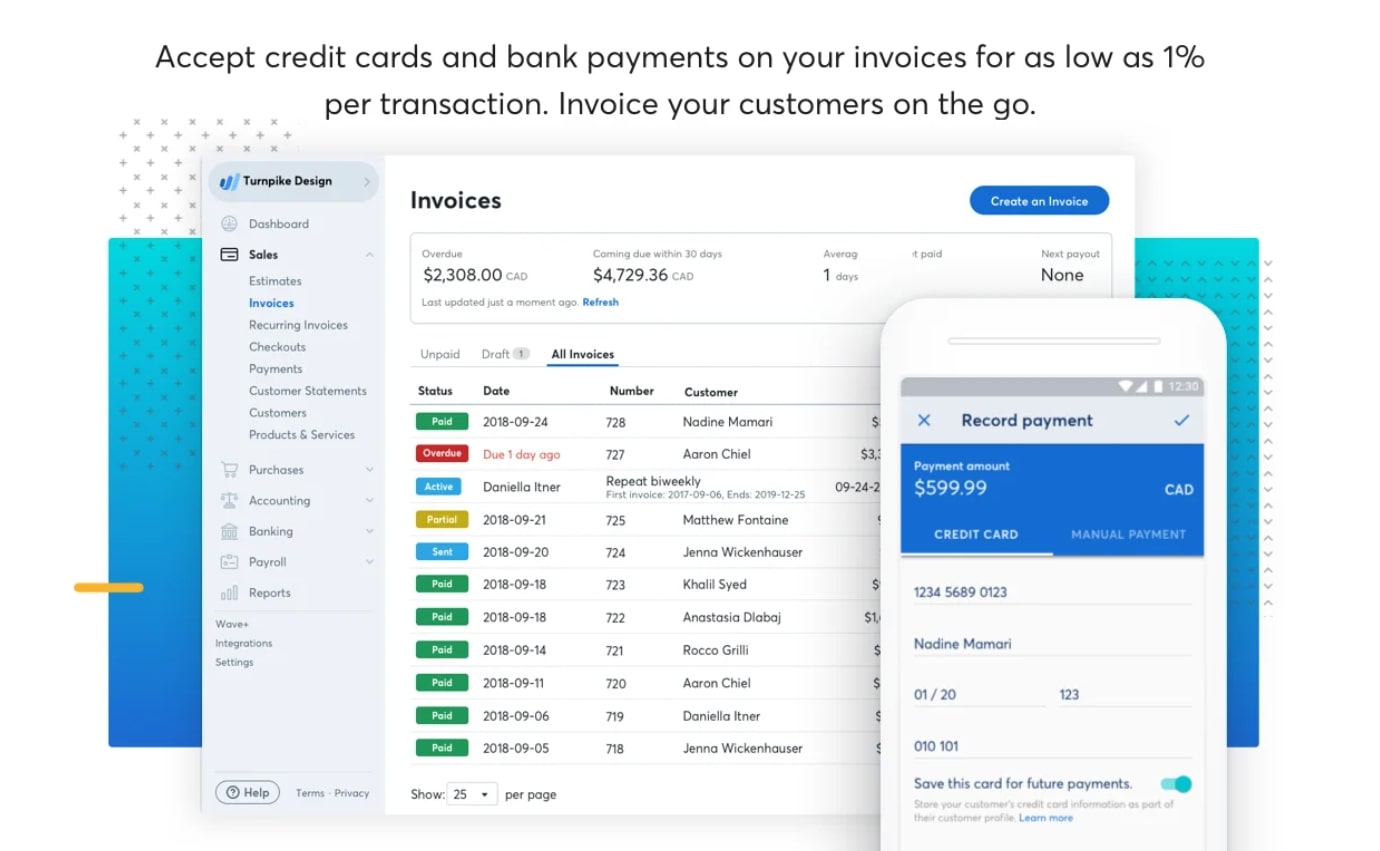

Wave

Wave is accounting software that’s completely free and it can be connected to your PMS of choice via Zapier. If you’re running a smaller rental business, then this simple and straightforward solution might be perfect for you.

Here’s an overview of Wave’s benefits:

- Unlimited income and expense tracking

- You can add other property owners or accountants

- Unlimited bank and credit card connections

- Access to helpful reports such as “Overdue Invoices & Bills” and “Profit & Loss”

- Available for Web, iOS, and Android.

Pricing: Wave for accounting is free, but it is a bit basic. For example, features that allow you to manage payrolls and receive payments are not available for free. Make sure to check their pricing page for additional features.

Reputation: Wave has a 4.4 score on G2. Users love it for ease of use (it has an above-industry rating of 9.0), quality of support, and ease of setup.

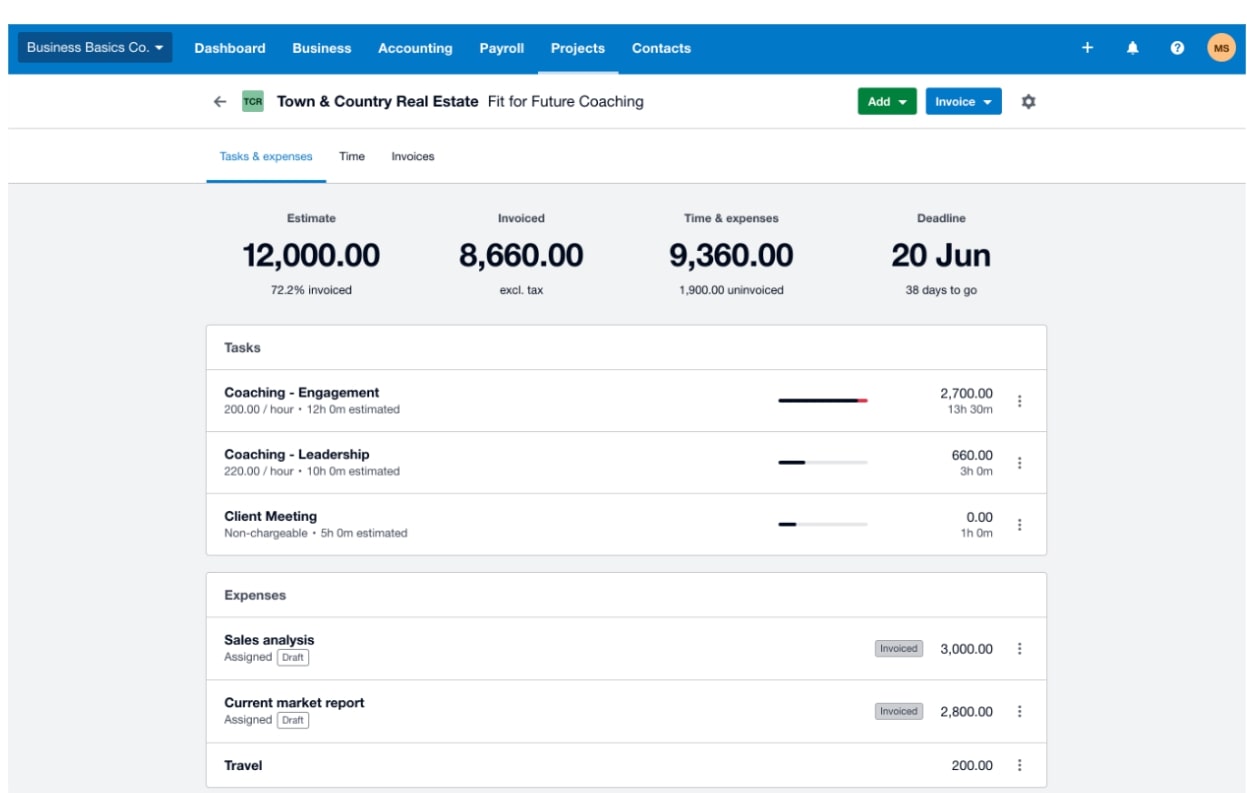

Xero

Xero is another affordable accounting software that offers a nice set of features for Airbnb hosts. The Xero accounting mobile app allows you to do the following:

- Easily manage invoices and identify which ones are paid and which are not

- Reconcile transactions

- Track your expenses

- Keep notes about guest interactions within the app

- Pay staff online or integrate a payroll app with Xero (if you have a larger team)

Pricing: Depending on the plan you choose, Xero will cost you $22-$47 per month.

Reputation: Xero has 4.3 score on G2 and users love it for its ease of use, quality of support, and ease of setup.

How to choose the right Airbnb accounting software for you

To choose the right software for Airbnb accounting, you’re going to need to consider your use cases, how easy it is to use, what integrations it has with your existing tools, the reputation of the software, and the price. It’s also worth considering how easy it will be to import your data into the tool.

Consider your use cases

Some solutions are created with vacation rental businesses in mind, but there are also more general tools that you can make use of. The important thing is to map out what exactly you need from the Airbnb accounting software.

Ask yourself:

- Which parts of your business do you need to automate the most?

- What features does the accounting software need to have?

- What’s your current business model and how does it correspond with the software you are considering?

Some tools might have a great reputation and tick a lot of the other boxes below, but might not be a great fit for a vacation rentals business, where some specialized tools shine.

Ease of use

Most of the software we mention here is quite user-friendly. This can be especially important if you’re not a tech-savvy person. In addition, maybe you don’t have the budget to hire tech support to help with onboarding or to solve any technical problems that occur. Your future team members will also appreciate the ease of use. To test what’s the exact learning curve, ask for a demo or sign up for a free trial before committing to a monthly or annual subscription.

Integrations

Integrations save a lot of time that you’d normally waste on switching between different dashboards or tabs. Instead of having your data scattered over different systems, you can set automated workflows or centralize your data in a single system. Check if your potential accounting software integrates with a PMS like Hostfully or is supported by Zapier.

Reputation

Before deciding on your accounting software, you should search for social proof. This includes online reviews (G2, Capterra), case studies, customer testimonials, and the reputation the company has across different communities. Pay attention to what users matching your profile or business model say about the tool, and what problems it solves for them.

Price

Of course, you need to choose a tool that fits your budget, but don’t get hung up on pricing alone.

One of the most common mistakes new rental property owners make is to go for a cheaper option to save a few dollars a month. Tools that don’t fit your needs can hamper your ability to grow and achieve your goals. That’s because free or cheap accounting software has limitations that will show as you grow past a certain property count. But you’ll eventually need to switch to a more advanced option and that brings the potential for data loss in the process of migration.

That’s why it’s always worth investing a bit more in accounting software that fits your needs. Otherwise, you could end up paying more in the long run.

Here are some things to bear in mind while assessing pricing:

- Consider how much and when you intend to scale and evaluate if the software is flexible enough to allow you to grow

- Don’t get caught up on the differences between fractionally cheaper tools: It’s always worth paying for the software that has the integrations and features you need

Easy to import data

You’ll also want to give thought to how easy it is to import data into your accounting tool. This is important because you want to avoid manually inserting data if possible and minimize the risk of any discrepancies in your data. Some PMP software like Hostfully offers helpful tools to export data to the integrated accounting software.

Key takeaways on choosing the best Airbnb accounting software

Accounting software can be of great help for managing your vacation rental finances. It can help you make tax savings easier, track expenses better, automate income and expense filling, simplify owner reporting, and make educated business decisions based on data.

If your vacation rental company is large or planning on growth, you might consider Xero or the technology and services provided by Ximplifi. Safe Accounting, Wave, and QuickBooks are more tailored for smaller businesses.

To choose the right accounting software, make sure you:

- Consider your use cases and identify the features that you need

- Evaluate the ease of use by signing up for a demo or a free trial

- Check for integrations that will improve your productivity and make business accounting easier

- Assess pricing plans

- Check online reviews

In the end, you should think in terms of streamlining certain parts of your workflow, and automating manual or repetitive tasks by leveraging integrations with a PMP like Hostfully. It’s got all the features you need to grow your vacation rental business, reach more customers, and create great guest experiences. Use a single software to manage listings on Airbnb, Vrbo, or other OTAs, see and close bookings faster, and upsell your guests.

Frequently asked questions about Airbnb accounting software

What software can create your Airbnb invoice?

There are several software tools you can use to create your Airbnb invoices. Some popular tools include QuickBooks, Freshbooks, Xero, Wave, and more.

Are there negative aspects to using Airbnb to manage bookkeeping?

Capturing all expenses related to your Airbnb business can take a lot of time if you choose to do it in Excel or Google Spreadsheets. To manage bookkeeping efficiently, you should use dedicated software.

How much does Airbnb accounting software cost?

Airbnb accounting software is priced between $12 and $90 per month, depending on the vendor and pricing plan.

Can you link Airbnb to QuickBooks?

Yes, it is possible to link Airbnb and Vrbo to QuickBooks using BnbTally. When you create a connection, your listings get synced directly from Airbnb and Vrbo. You can then set specific accounting rules for each listing.