Perhaps you’ve heard of the short-term rental tax loophole. This rule allows you to treat your income as active rather than passive and opens up powerful tax advantages.

The short-term rental tax loophole isn’t just for full-time real estate investors either. Homeowners and small businesses can benefit from the loophole provided they meet all the requirements.

But many hosts miss out because they’re unaware of the loophole or misunderstand how it works. Some lose the tax break by simply structuring their business the wrong way. The IRS has strict conditions and it’s easy for your tax strategy to fall short without you realizing it.

Let’s see whether you qualify. This article explores how the short-term rental loophole works, how to meet the criteria, and what to avoid.

The US short-term rental tax loophole

Normally, the IRS considers managing a rental property to be passive rental activity unless you’re a qualified real estate professional. As a result, you can’t use business losses to reduce your taxable income. You must bear the full financial burden of expenses and depreciation.

But the IRS makes exceptions. In Publication 925, they state that they’ll treat passive rental income as active if you materially participate in the business and meet one of the following criteria:

- Short stays: Guests only stay for an average of seven days or less.

- Substantial services: The average stay is 30 days or less, and you offer substantial services that are on par with a hotel or similar hospitality business.

- Extraordinary services: The main value comes from the services you provide, not the property itself. For example, you run a wellness retreat with full-time staff.

- Side activity: Your income is incidental to another business activity and earns less than 2% of the property’s value in rent.

- Non-exclusive, drop-in use: Your property is only available during business hours for short-term use such as a meeting room or studio.

- Corporate use: You make the property available to a business you’re involved in.

What counts as material participation?

The IRS has material participation tests to determine whether your income counts as non-passive activity. Generally, you must fall into one of the following categories:

- You spent over 500 hours working on the business.

- You did most of the work even if it was under 500 hours.

- You did almost almost all the work yourself.

In other words, you must either have spent a significant amount of time on the business OR have taken responsibility for the majority of the work.

A look at the short-term rental tax loophole in action

So far, everything we’ve discussed has been theoretical. Let’s see how the short-term rental tax loophole would apply to a real-life situation.

Imagine you own an Airbnb apartment and most guests stay for two to three nights. You spend a little time every week managing bookings and communication, which adds up to around 150 hours per year. All this means you qualify for the tax loophole.

Your rental business takes about $25,000 in bookings annually. On top of this, you have a regular job making $100,000.

Throughout the year, you accrue around $10,000 in expenses. Your business also loses $30,000 on paper due to your property, furniture, and appliances depreciating in value. This brings your total losses to $40,000, leaving you with a net loss of $15,000.

Without the loophole, you can’t deduct this $15,000 loss against your full income. You must carry it forward and wait for your revenue to offset it.

But with the loophole, you can deduct this amount from your salary and pay taxes on $85,000 instead of $100,000. You could save around $3,000 to $4,000 in taxes depending on your location.

Tips for reducing taxes on short-term rental properties

Making the most of the short-term rental tax loophole requires a little bit of work. Here’s what you need to do to get the biggest tax savings:

Double-check whether you qualify for tax breaks

Never assume anything. You might think you don’t qualify for a tax advantage when in reality, you just need to adjust your business structure.

For example, it’s easy to overlook your contributions to the business. You may believe cleaners and maintenance crew spend more hours working at your properties but underestimate how long you put aside for bookings, channel management, and guest communication. Just two half-day shifts a week can easily push you over the 500-hour threshold and allow you to qualify for the loophole.

Keep detailed records to prove you meet conditions

Make sure you can demonstrate your eligibility for the tax loophole in case of an IRS audit. That means tracking the average length of guest stays and recording staff shifts.

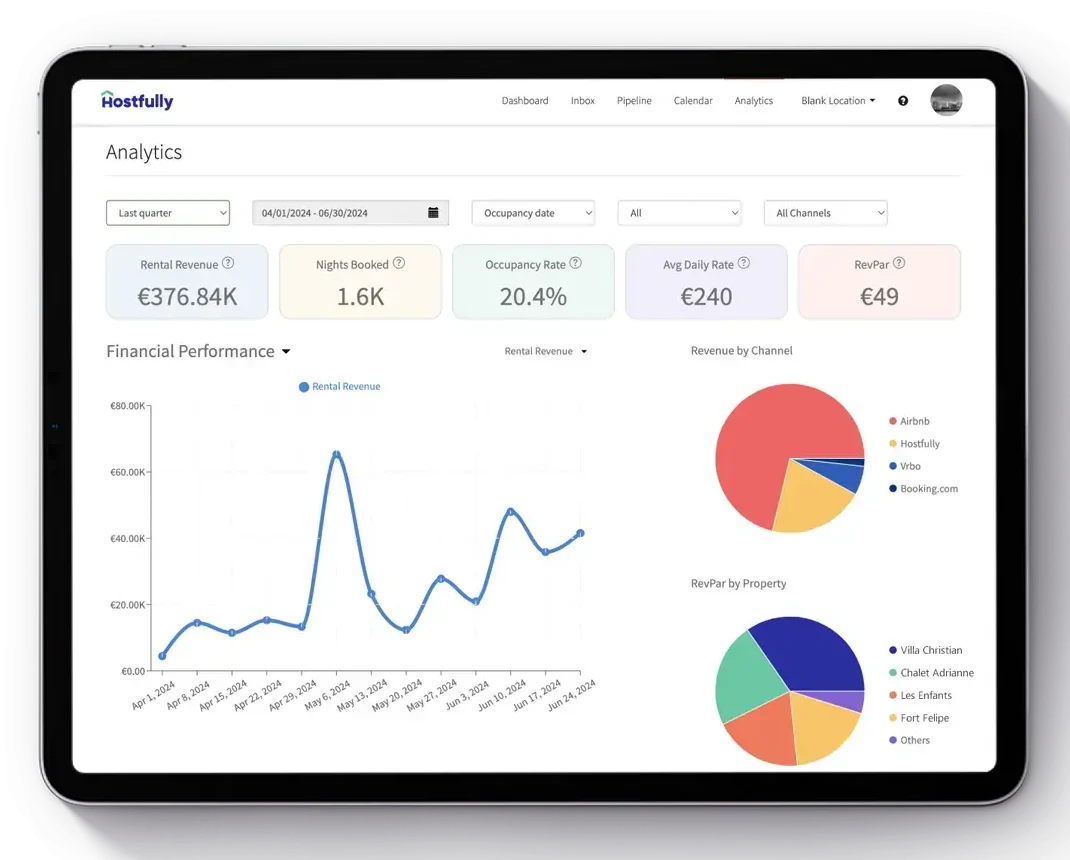

But keeping records can be time-consuming and error-prone, especially if you manage several properties. Use a Property Management System (PMS) like Hostfully instead to automatically track a variety of useful metrics, such as:

- Booking prices and fees

- The average length of stay

- Expenses

- Hours worked

- Tasks assigned through our management tool

Understand which expenses count

“Deductions are everything,” says Adam Hamilton, Co-founder at REI Hub, “Even the smallest expenses add up. So, throughout the year, you want to make sure to keep a detailed, organized record of every single dollar spent on the short-term rental property, from cleaning supplies to repairs to improvements to marketing.”

The key is to look beyond the obvious. For example, have you taken any short-term rental management courses during the tax year? You can include any fees you paid in your federal tax return too.

And what about your financial activities? Expenses like property taxes and mortgage interest can often count towards tax deductions too.

Again, PMS like Hostfully can help you keep better track of these expenses. The software records recurring costs like cleaning fees and channel commission so you don’t overlook any possible savings.

Take advantage of bonus depreciation while it lasts

US taxpayers can deduct a large portion of their property improvements and assets in the first year instead of spreading it over time. This means you have more upfront capital to invest in your business and get it off the ground.

But act quickly as the IRS is phasing out this scheme. The amount is set at 40% for 2025 and this will continue to drop year-on-year until it hits zero.

Invest in accounting software and expertise

Unless you’re an expert, managing your own books can be a risky endeavor. You’re unlikely to have the knowledge to successfully navigate your country’s extensive rules and guidelines for rental property operators.

Accounting software like QuickBooks can take care of the day-to-day bookkeeping. If you integrate them with your PMS, they can automatically track income and expenses. Just make sure your PMS has a choice of accounting integrations that work in your region like Hostfully does.

When it comes to tax season, look for a certified professional accountant (CPA) to help file your tax return. They can double-check you’ve met the conditions for the loophole and include every single possible expense.

Consider your location

Tax regulations vary across US states and cities, meaning the IRS rules are unlikely to give you the full picture. Research before you invest anywhere to check if your type of vacation rental business will be able to generate positive cash flow and turn a profit.

For example, Pete Evering of Utopia Management says that California isn’t a particularly favorable tax environment for short-term rentals. “It has a high state income tax, strict local regulations, and additional tax burdens. Operators have to navigate transient occupancy taxes, which can be as high as 15%, along with business licensing fees and zoning restrictions. The state’s progressive income tax structure also means that rental profits are taxed at some of the highest rates in the country.”

He notes there’s a place in the market for operators who know how to navigate these tough requirements. “Popular destinations like Los Angeles, San Diego, and the Bay Area consistently attract travelers. Even with taxes and fees, the profit margins can remain attractive compared to long-term rentals. Many STR owners also optimize their listings by targeting mid-term renters, which can bypass some local STR regulations and reduce turnover costs.”

Short-term rental business intelligence tools can help you understand trends in prospective areas and determine whether your business would be profitable there.

Rely on software for support

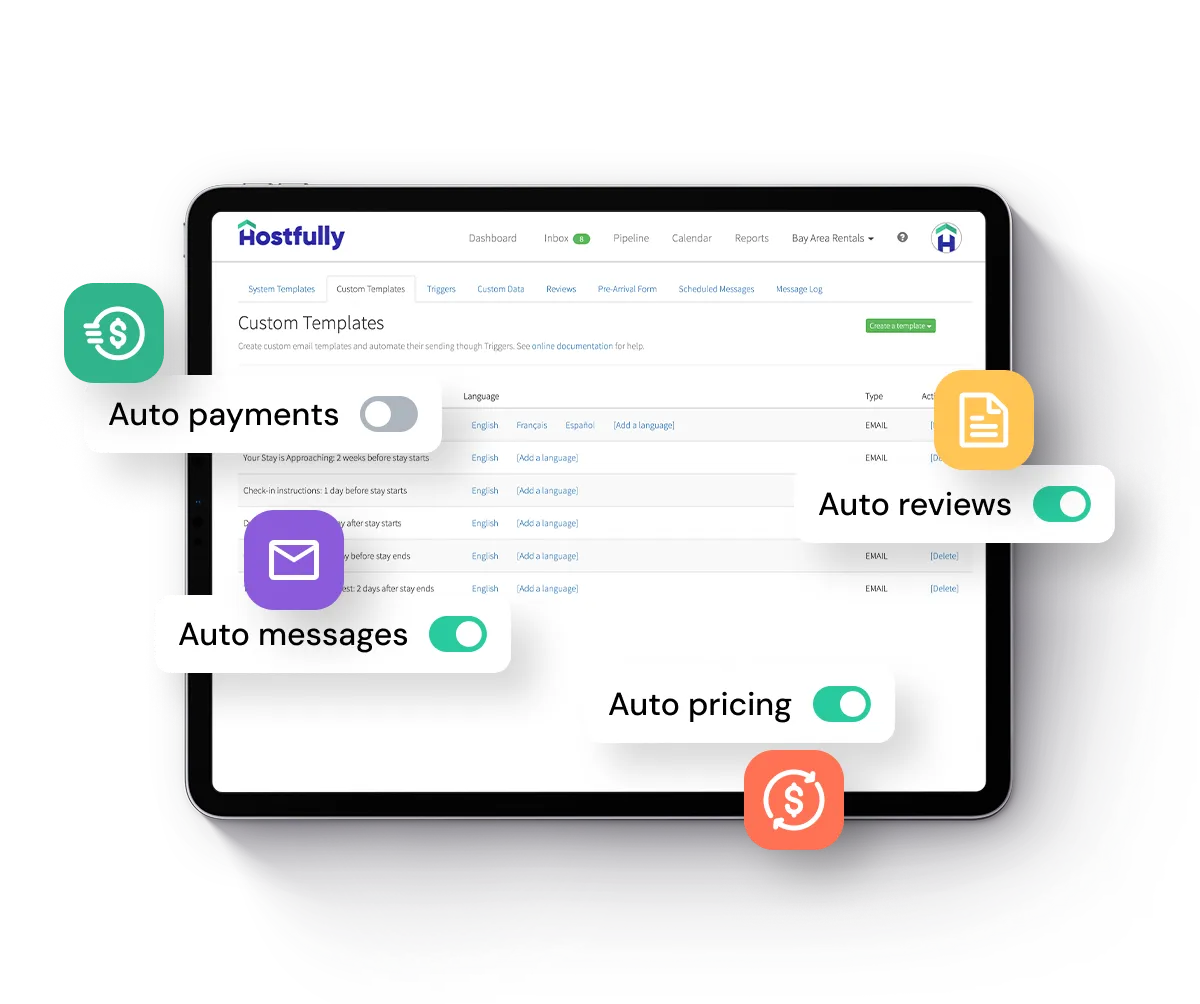

If your short-term rental business isn’t your main job, you may struggle to meet all of the IRS criteria for the tax loophole. You might not have 500 hours to spare or the capacity to manage most of the work.

Automation for short-term rental businesses can reduce the amount of hours needed to operate your business. You don’t need to rely on outside help but you won’t need to spend every spare minute outside of your normal job taking care of tasks. And with a robust PMS like Hostfully, you can streamline rental operations such as booking management, listing management, and guest communication.

Common pitfalls with the short-term rental tax loophole

You may be reluctant to take advantage of the short-term rental tax loophole because you’re concerned about causing compliance issues.

While these feelings are understandable, you can mitigate the risks simply by being aware of the most common pitfalls. Here are some typical mistakes to avoid:

- Misunderstanding the average stay rule: You must decide whether to commit to short-term rentals versus long-term rentals. Hosting extended stays or allowing a mix of booking types can accidentally push you into passive tax treatment. Ensure the vast majority of bookings are either under seven days or under thirty days when combined with special services.

- Failing to prove material participation: Without strong documentation, the IRS may reclassify your income as passive. It doesn’t matter if you’ve actually put in the hours if you don’t have the proof.

- Mixing professional and personal use: Staying in the property for long periods or letting a friend live there for free may affect tax deductions, ultimately making it hard to claim write-offs or depreciation.

- Overlooking self-rental rules: Renting your property to a business you own or participate in could disqualify you. Avoid hosting regular meetings or organizing corporate retreats for your partners through your own properties.

- Filing the incorrect forms: Reporting active instead of passive income usually calls for an entirely separate set of forms. If you’re in the US, for example, you file Schedule C and not Schedule E.

Ultimately, success comes down to understanding the regulations, knowing the market, and ensuring you follow good best practices for short-term rental management.

As Tim Choate, Founder & CEO of Red Awning says, “The tax environment for our industry can be a noose or a lifeline depending on location and property type. This market is sometimes friendly with local tax benefits around rental investment when leveraged appropriately, and at other times can be fussy due to transient occupancy taxes and local fees. You need to adjust your plan to the local tax environment.”

The bottom line on protecting your bottom line

Check to see whether you qualify for the short-term rental tax loophole. If you’re not taking advantage of this rule, you could be leaving thousands of dollars on the table.

But the tax rule only works if you conduct yourself like a proper business. You must directly manage your operations, track your financial performance, and assign tasks to staff members. Otherwise, you leave your company open to tax compliance issues.

All this sounds like a lot of extra hard work, doesn’t it? But with the right software, you can achieve everything without significantly increasing your workload. Invest in Hostfully PMS to automate essential processes and keep track of expenses, letting you save costs without the risks.

Frequently asked questions about the short-term rental tax loophole

What is the short-term rental tax loophole?

The short-term rental tax loophole is an IRS rule that allows qualifying hosts to treat their earnings as active income rather than passive. This means you can deduct rental losses and expenses against your regular W-2 income and significantly reduce your tax bill.

How can I qualify for the short-term rental tax loophole?

You can qualify for the short-term rental tax loophole by meeting two main conditions: Your average guest stay must be seven days or fewer and you must directly participate in running your business. That usually means spending between 100 and 500 hours on tasks like bookings, cleaning, and guest communication.

How can I maximize tax savings using the short-term rental tax loophole?

You can maximize tax savings using the short-term rental tax loophole by including all eligible expenses. You can also take advantage of bonus depreciation provided you set up your business before the end of 2026.